Registration and Login FAQs

-

Toggle accordionHow do I sign up or log in?

Answer: You can find the buttons to register or log in on the main login page..

-

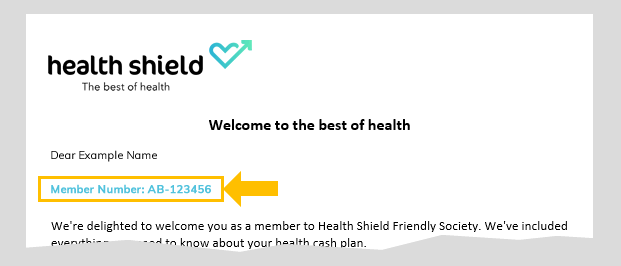

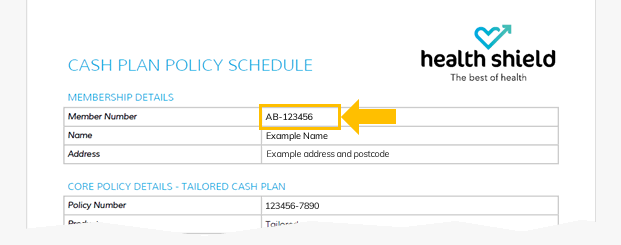

Toggle accordionWhere can I find my member number?

Answer: You can find your member number in your welcome pack, on the last payment notification for a claim, or in any communications you’ve received from Health Shield. See some examples below.

-

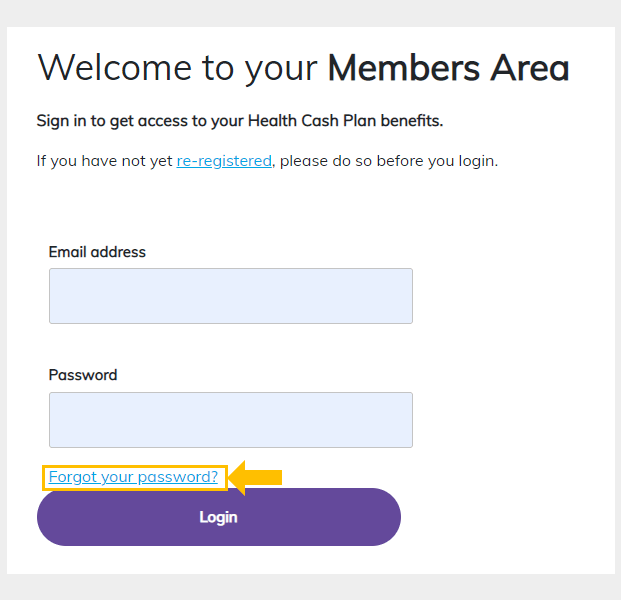

Toggle accordionHow do I reset my password?

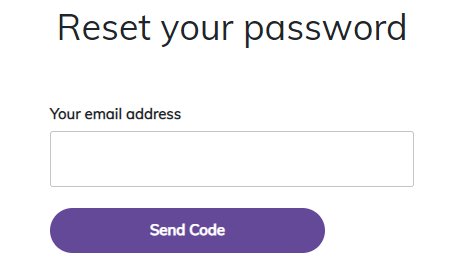

Answer :To reset your password, go to the login page and click "Forgot your password".

Enter the email address you registered in the screen below and click "Send Code".

Amending details and cover FAQs

-

Toggle accordionHow can I update my Personal Details?

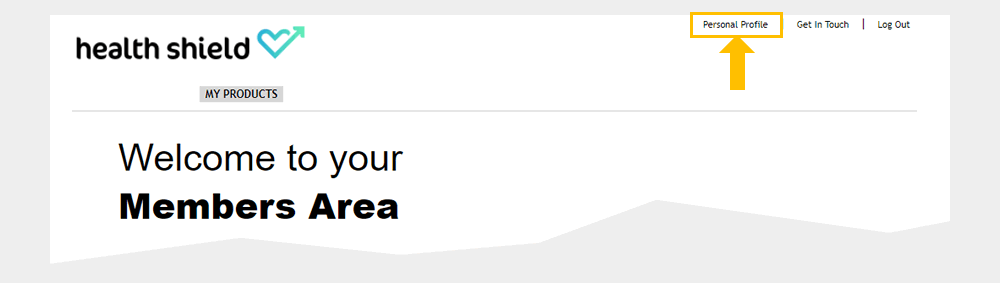

Answer: To update your personal details, log in to the Members Area, click "Personal Profile", then "Edit" to make changes and "Update" to save them.

1) Click "Personal Profile".

2) Scroll down and click "Edit" then edit your details.

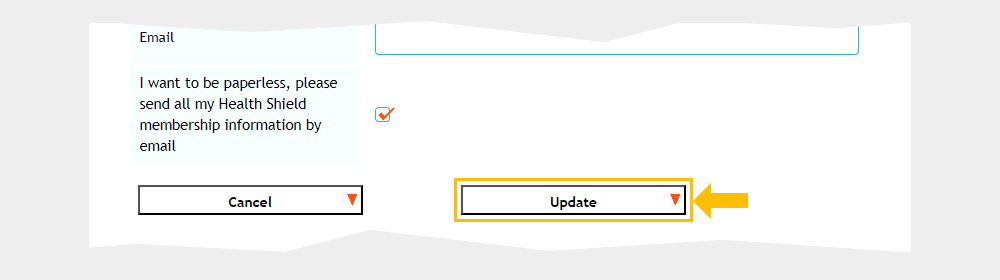

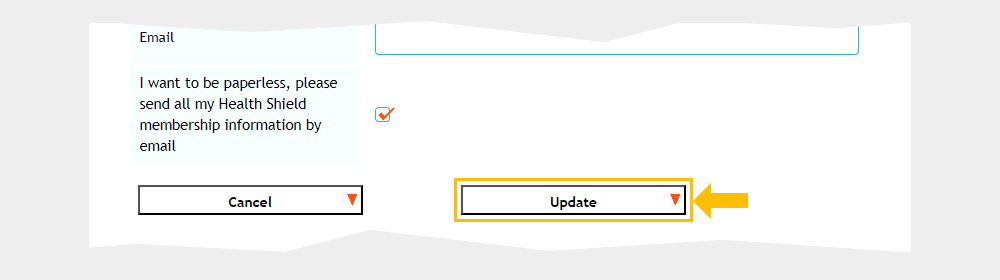

3) When you have completed editing, click "Update" to save and update your details.

-

Toggle accordionHow can I add my partner/child/children to the cash plan?

Answer: To add your partner/child to the cash plan, log in to the Members Area, click on your product's main button, then "My personal Profile", "Additional persons covered", "Add an additional person", fill in the form and click "Add person".

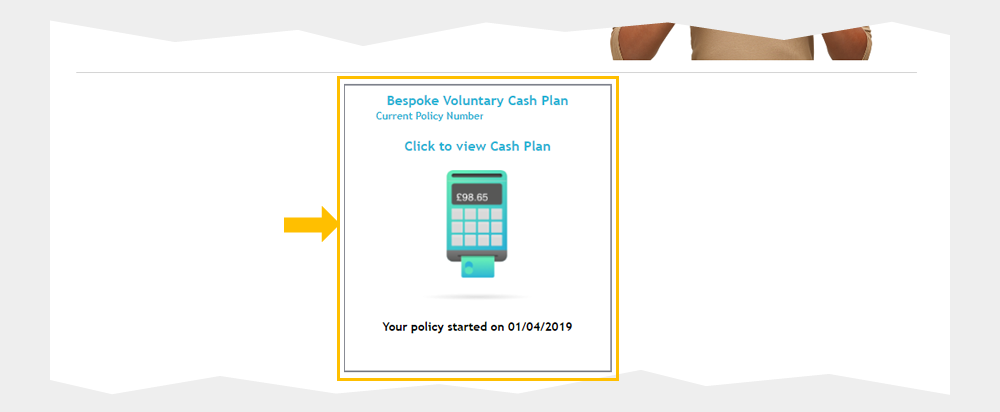

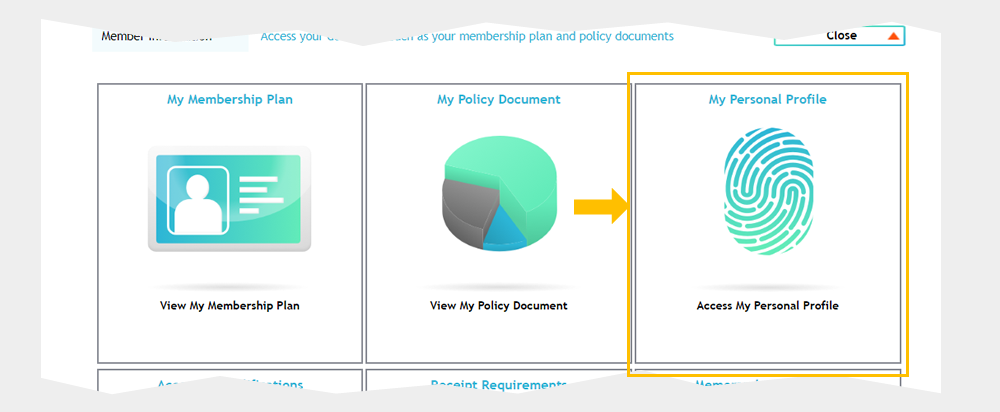

1) Click your product's main button:

2) Click "My personal Profile"

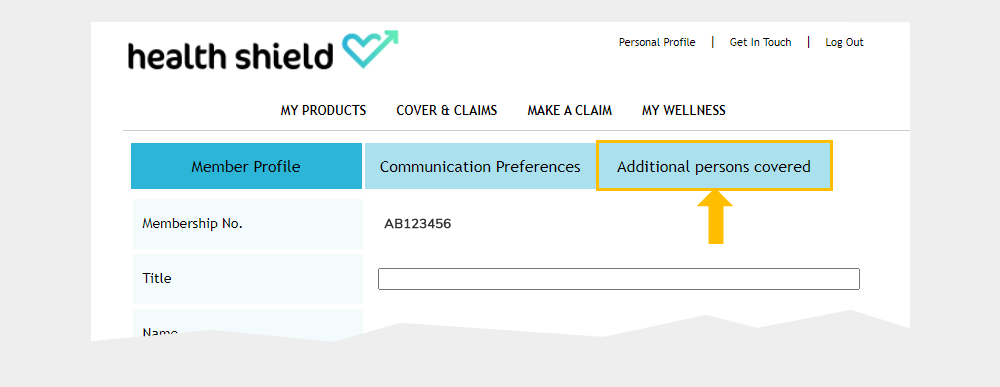

3) Click "Additional persons covered" on the new screen which appears.

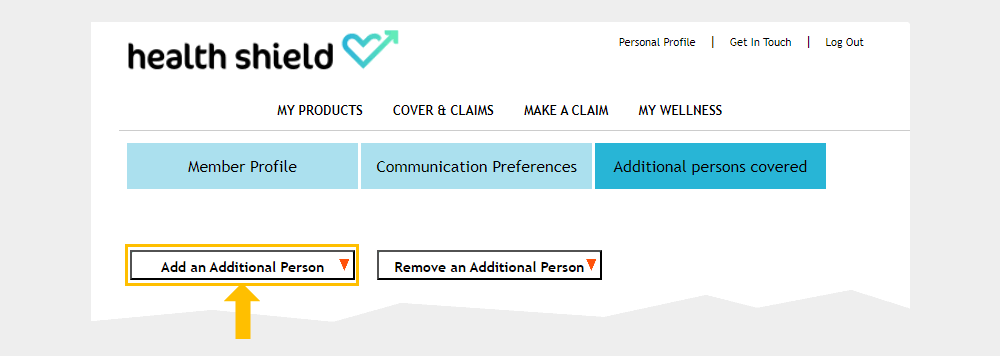

4) Click "Add an additional person".

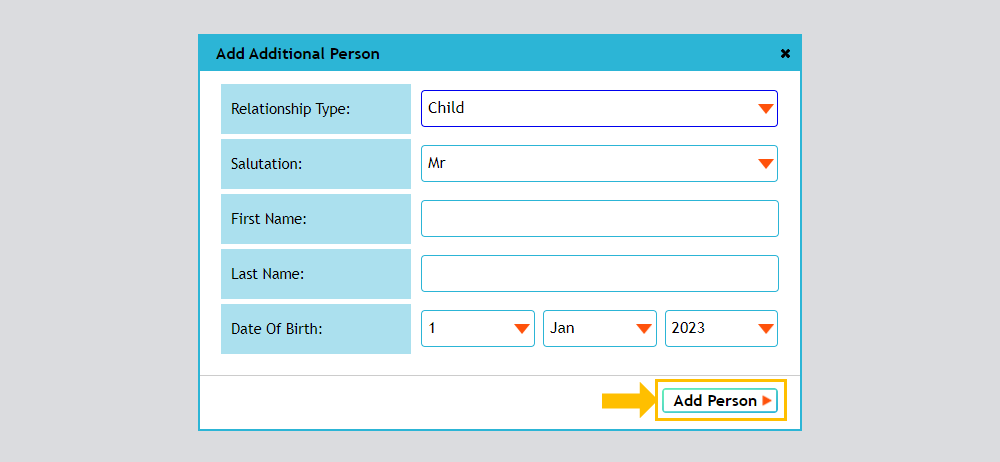

5) Fill in the form and click "Add person". The information will be sent to Health Shield and if adding a child/children - we will register from here. If adding a partner we will be in touch with the next steps on receipt of the request.

-

Toggle accordionHow can I amend my level of cover?

Answer: Fill out the contact form and request to amend your level of cover and we will be in touch with the next steps.

Membership info FAQs

-

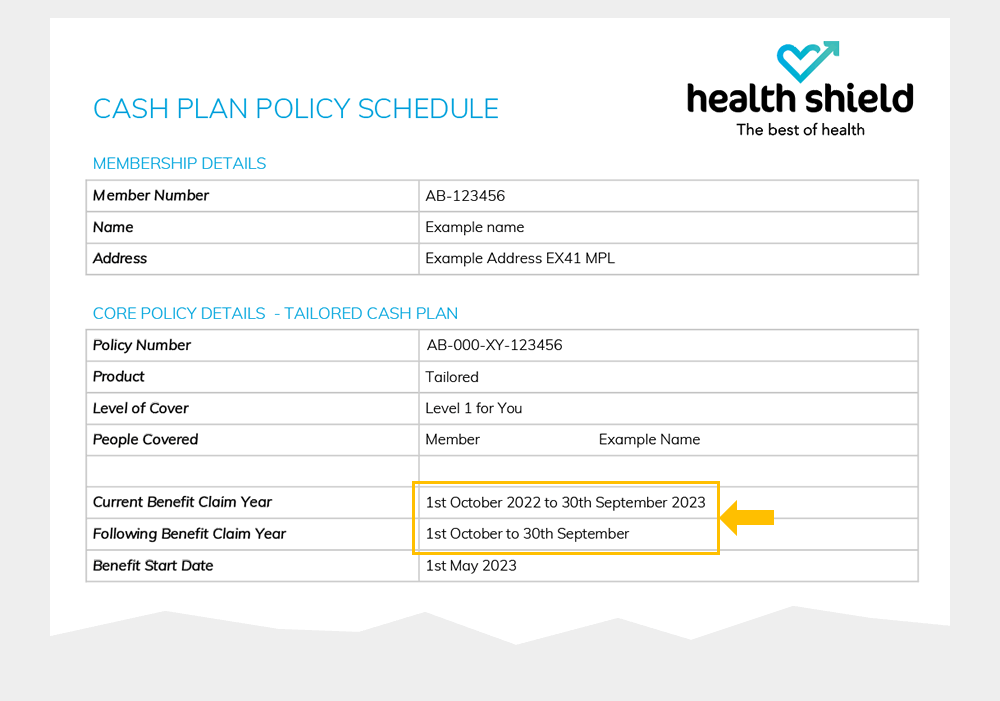

Toggle accordionWhen does my benefit year run from?

Answer: Your benefit year is shown in your welcome pack, the image below shows where to find this on your policy schedule.

-

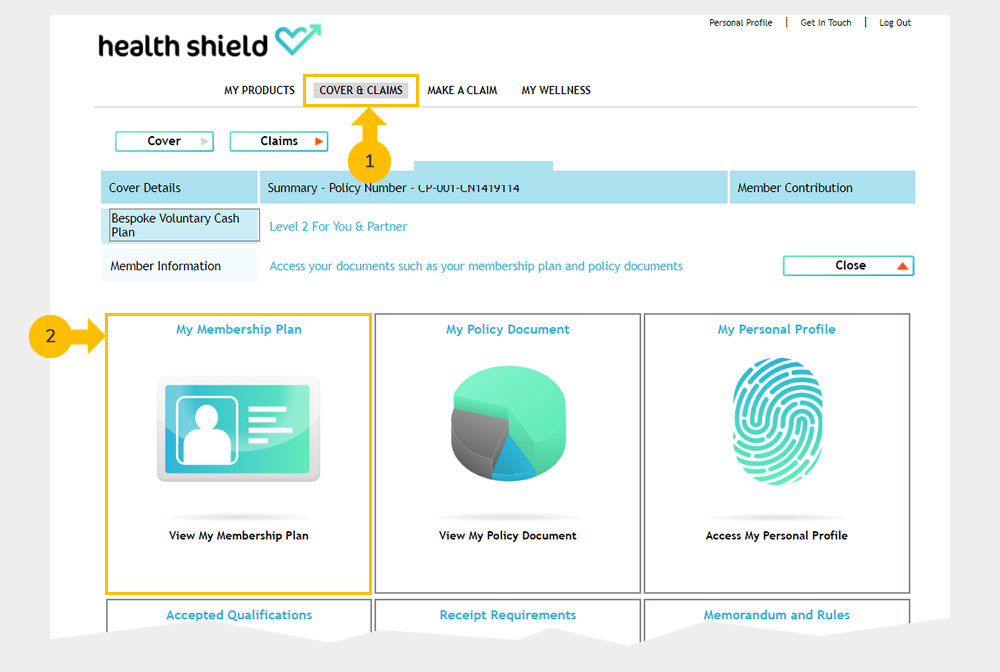

Toggle accordionWhat benefits are available on my cash plan?

Answer: To check your available benefits, click "Cover and Claims" then "My Membership Plan" in the Members Area.

-

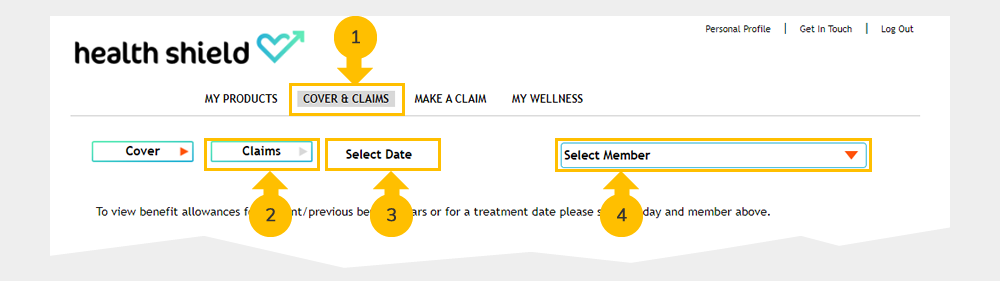

Toggle accordionWhere can I check my benefit allowances?

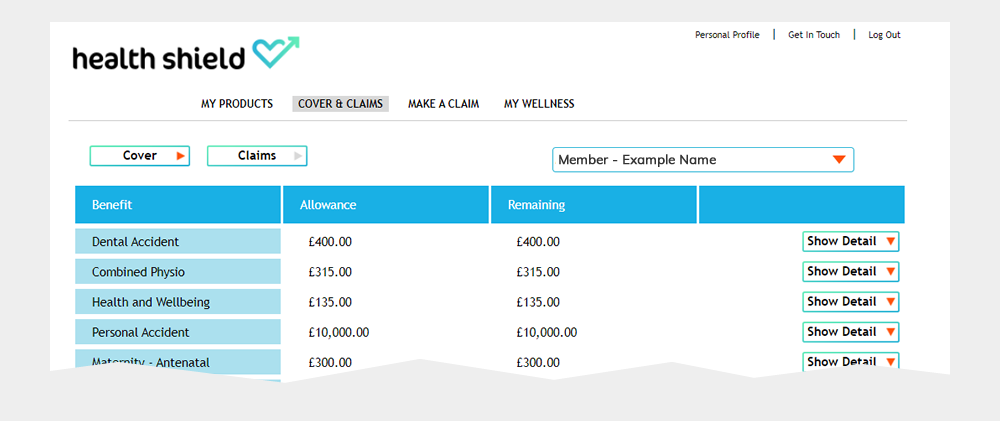

Answer: Login to the members area. First, select (1) "Cover and Claims" then (2) "Claims". Click (3) "Select a date" and choose today's date. Finally click (4) "Select member", choosing the member whose allowances you wish to display.

Your allowances will then be displayed, similar to the example below.

-

Toggle accordionHow many times can I claim in one benefit year?

Answer: We will not pay more than the maximum benefit amount for you, your partner or dependent children (if they are covered) within each benefit year. What you are entitled to depends on your level of cover at the time of your treatment or when making a purchase.

Making a claim FAQs

-

Toggle accordionHow do I make a claim?

Answer: All information on how to make a claim can be found on this page: How to claim

-

Toggle accordionWhere can I find a list of accepted accreditations & qualifications?

Answer: Check our list of accepted qualifications before booking an appointment with a practitioner, except for dentists and opticians.

-

Toggle accordionWhere can I find the receipt requirements?

Answer: The receipt should contain details of the treatment provider, the person who received the treatment, type of treatment, date, and cost. Receipt requirements PDF

-

Toggle accordionHow do I update my bank details?

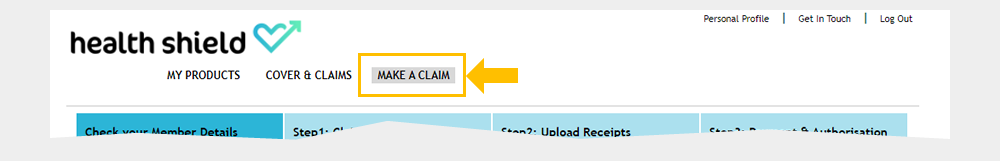

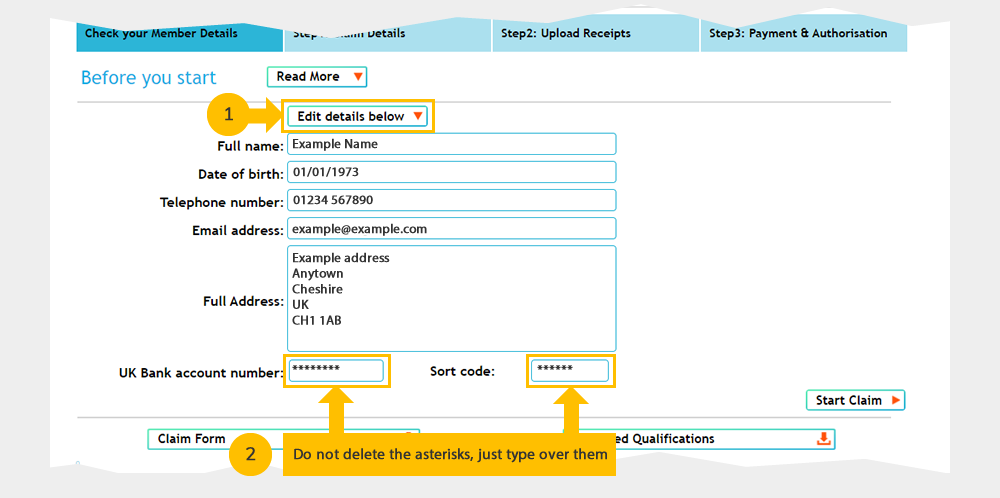

Answer: To update your bank details, click "Make a Claim", then "Edit your details below" and update your bank account and sort code details.

1) Click "Make a Claim" (Even if you are not making a claim - this is where the bank details are located)

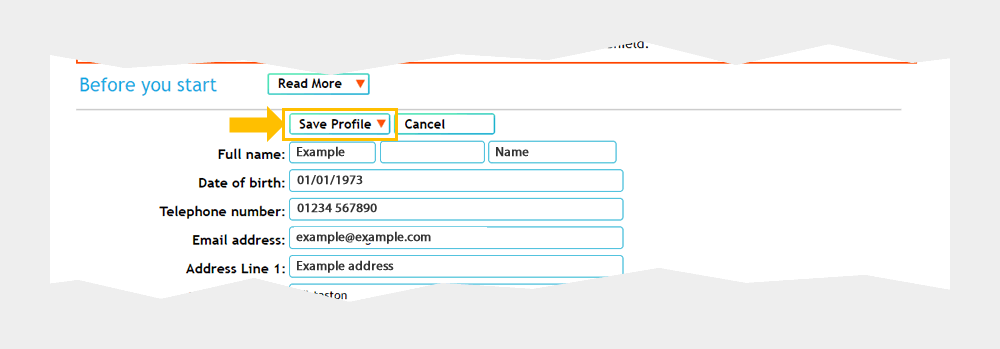

2) Click (1) "Edit your details below". Edit your bank account and sort code details as show below in step (2) below. Do not delete the asterisks, just type over them.

3) Then click "Save profile", and the details are updated.

-

Toggle accordionWhen will my claim be paid?

Answer: We aim to process valid claims within two working days and will notify you of the claim payment. Allow three working days for the BACS transfer to show as a credit in your account.

Additional information

-

Toggle accordionIf I leave my current job, can I continue with my membership?

Answer: You won’t be able to stay in your current scheme, but you can get in touch with our Customer Care team to find out the options available to you.

-

Toggle accordionHow to make a complaint

For more details on how to make a complaint to Health Shield, visit our How to make a complaint page.

-

Toggle accordionStill have a question?

Answer: Contact our Customer Care team if you have any questions.